avalara tax codes by state

You can copy and paste from an Excel. The Default Product Tax Code you entered under Setup Taxes will be automatically populated.

Enablement Steps For Advanced Taxation Nimble Ams Help

Ad Calculate current rates at the point of purchase.

. Every tax jurisdiction in AvaTax is assigned a unique jurisdiction ID code and name. Must be a legal. 77 rows Sales tax.

You can either start typing and select from the list of available tax codes or paste the appropriate tax code. The standard rate is 13 as of September 28 2021. 149 rows AvaTax for.

Add up to 20 tax codes. 150 rows AvaTax for Communications supports tax calculation for a number of countries states territories and provinces. Content is shown for.

Address and get the sales tax rate for the exact location with the Avalara real-time sales tax calculator. The NSAI Technical Committee 002SC 12 on eProcurement has issued guidance to help suppliers that are starting to issue e-invoices with public bodies ie B2G. The new tax codes are not yet certified by SST states and as such.

Automate your sales tax process today. These tax codes are taxed at the full rate. P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code.

Some products require special tax treatment. P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code. Theyre useful in states like.

Find the average local tax rate in your area down to the ZIP code. When to map items. The Giveaway is open only to confirmed attendees of Scaling New Heights in Orlando FL on June 19-22 2022 the Event.

Go to System Utilities - Global Setup - Utilities- Avalara Utilities- Utilities and choose Create State Tax Codes. This makes them the wrong tool to use for determining sales tax rates. A state-by-state analysis of charging sales tax on services.

This will create a tax code record for every state as well as a county and a. By basing sales tax. Reduce your risk of an audit with greater accuracy.

Ad Calculate current rates at the point of purchase. When state legislatures in the United States implemented the first sales tax laws to boost revenues in the 1930s the American. However if your product falls in a different category you can enter.

If you sell items such as clothing food software medical supplies software subscriptions and freight map. Like so many other aspects of daily life sales and use tax compliance has been affected by the pandemic. Must be a confirmed employee of an Avalara partner.

Industrial production or manufacturers. Avalara Tax Research divides the content for each country by industry making it even easier to find your answers. We publish tables based on our latest.

Reduce your risk of an audit with greater accuracy. To ensure accurate tax calculation Avalara. The tax codes activated provide more granular support for many types of products and services including.

This change was effective in Avalara products on April 1 2018. The tax codes activated provide more granular support for many types of products and services including. What is Streamlined Sales Tax.

Tax codes PM020704 and. Automate your sales tax process today. Select the states in which you do business.

AvaTax uses these values to identify tax jurisdictions and apply the correct tax. General tax code for the retail sale of firearms PF030746 Gun locks trigger locks and cables does not include gun cabinets and cases PF030900 Ammunition General tax code for the. The new tax codes are not yet certified by SST states and as such.

50 rows Download a free sales tax rates table by ZIP code for any US state. Streamlined Sales Tax SST is a state-run program designed to make sales tax compliance easier and more affordable by offsetting the cost of using a tax. Next we won a mobile phone services company for a deal value of 176000 including AvaTax Communications and sales tax and registrations across 48 states.

In fact the top three risks to growth in 2022 are 1 the.

Up To Date 2021 North Carolina Sales Tax Rates Use Our Sales Tax Calculator Or Download A Free North Carolina Sales Tax R Tax Guide Online Taxes Filing Taxes

Understand Sales Tax Holidays In Avatax Avalara Help Center

Sales Tax Calculation Software Avalara

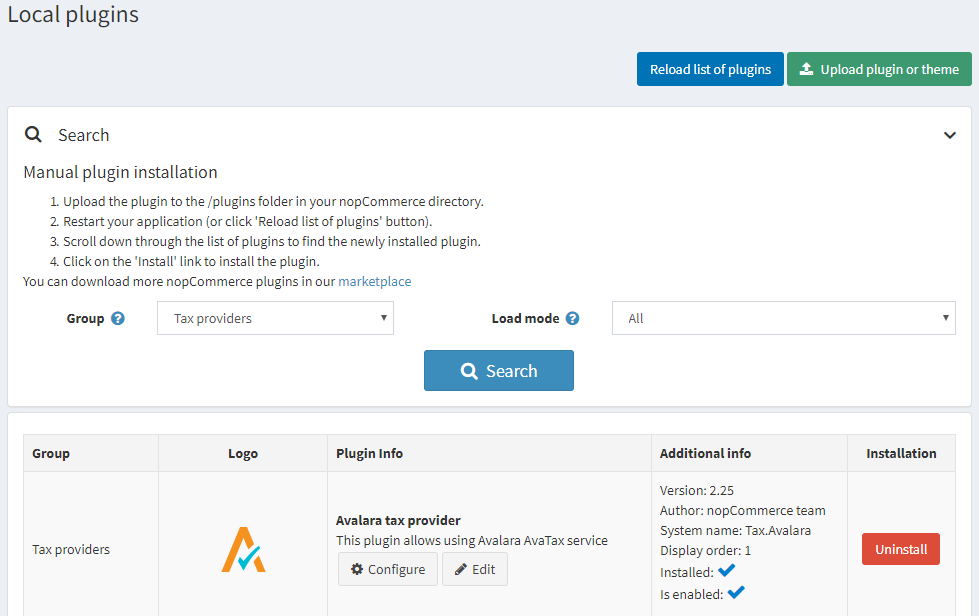

Avalara Application By Kibo Ecommerce

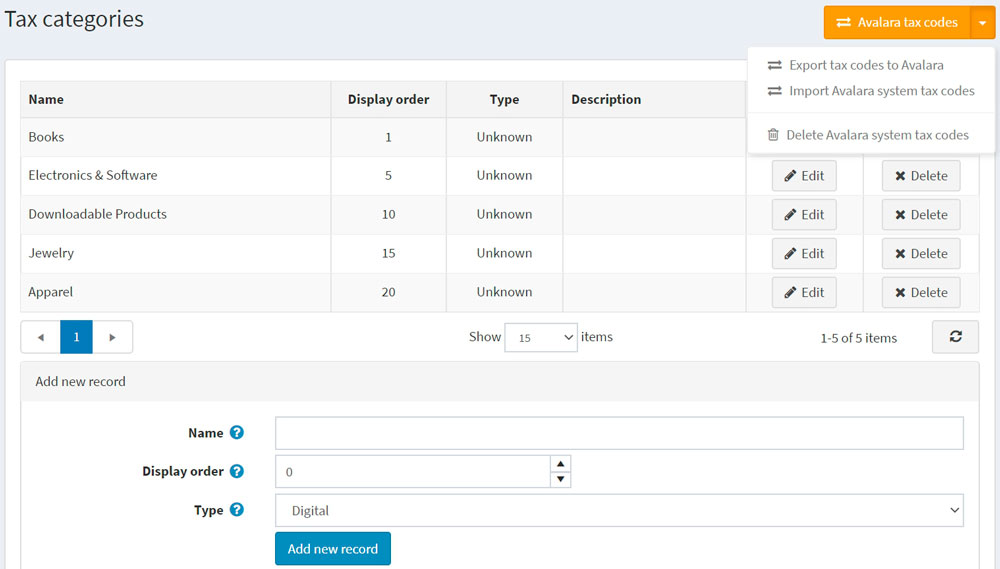

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

Avalara Avatax For Adobe Commerce Adobe Exchange

Avalara Avatax For Magento2 Sales Tax Md At Master Avadev Avalara Avatax For Magento2 Github

Avalara On Zoey Sales Tax Solutions For B2b Ecommerce

Sales Tax Datalink Vs Avalara Sales Tax Data Link

Avalara Tax Integration For Made2manage Progressive Edge

Texas Sales Tax Rate Changes October 2018

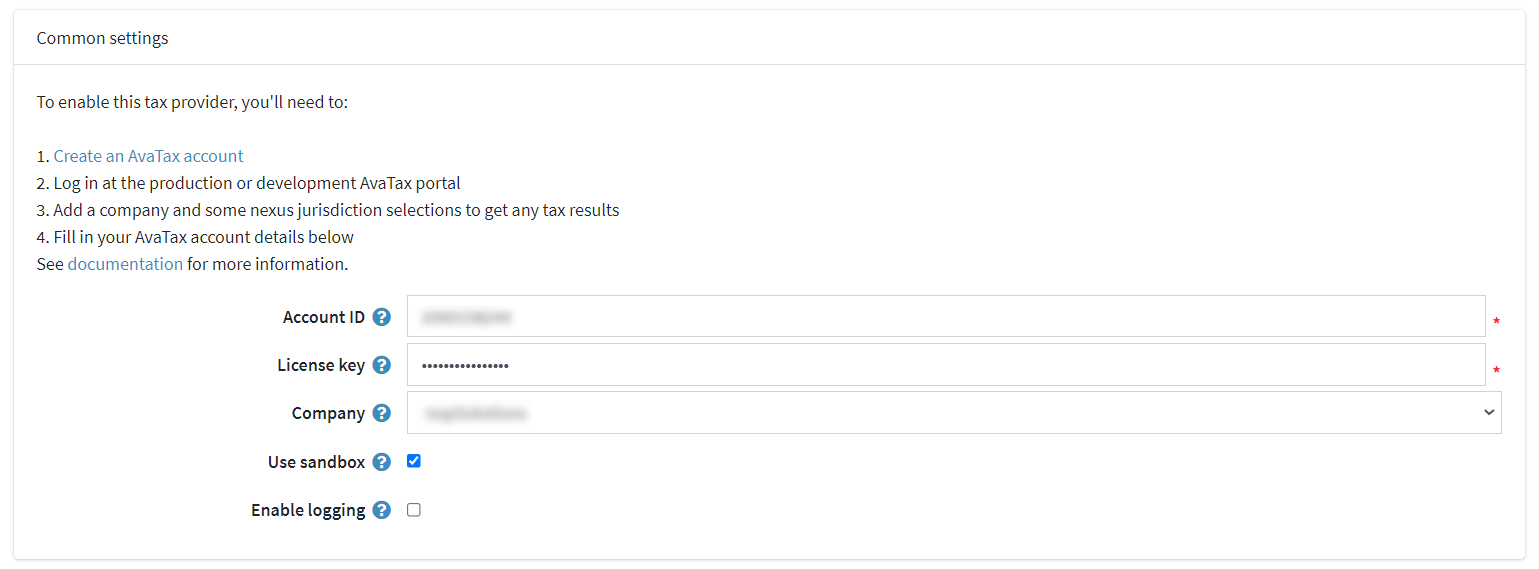

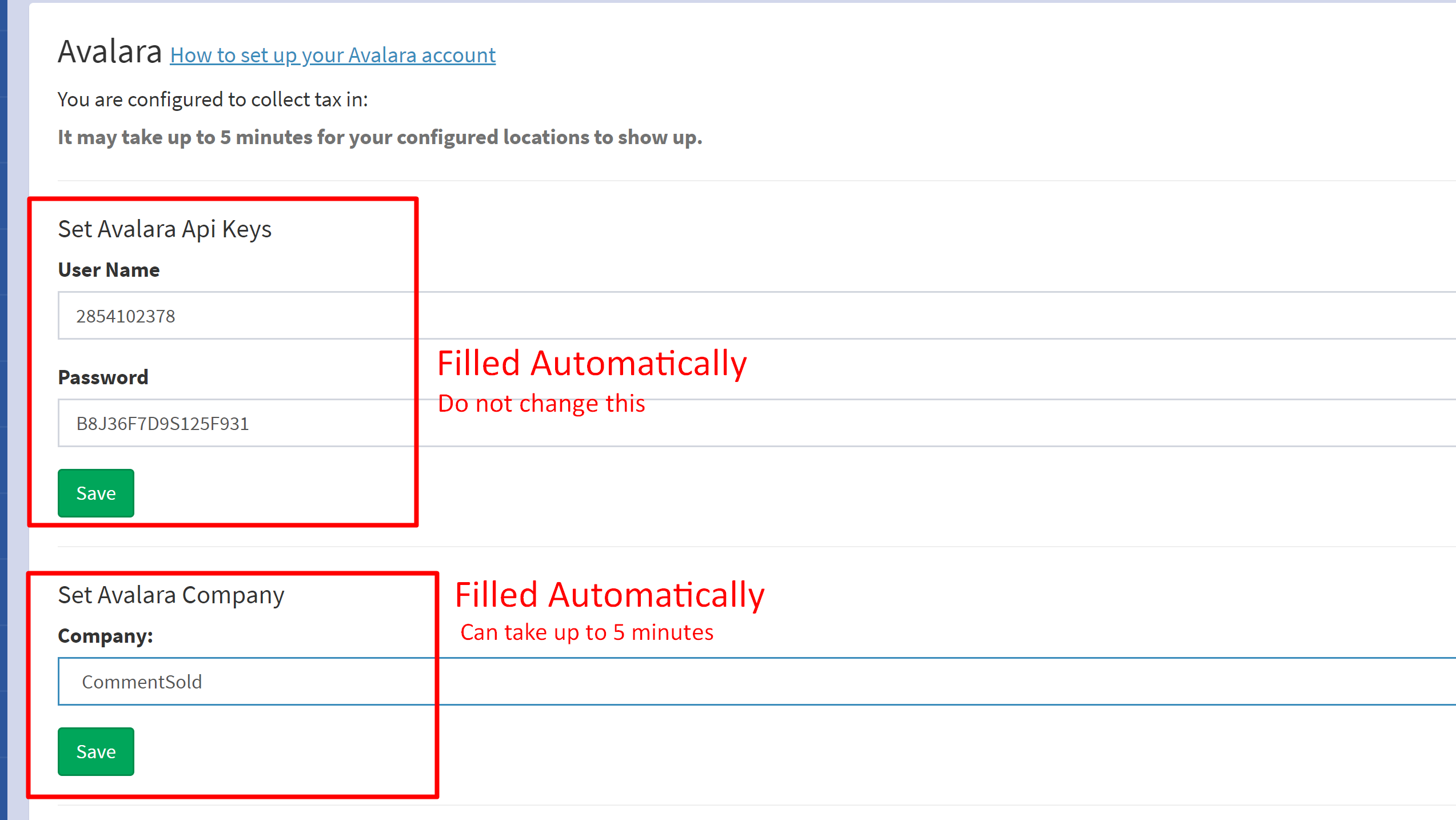

Using Avalara For Sales Tax Commentsold

Understanding The Avatax For Communications Tax Engine Avalara Help Center